In the business world, invoices play an extremely important role in keeping the financial engine running smoothly. When it comes to GST filing (Good and Services Tax), we need to manage invoices which aren’t just about sending bills; rather, it’s the key to financial success. Beyond the conventional understanding, this guide is your compass in demystifying GST invoicing. From meeting compliance standards to embracing digital tools, we are here to break it down for you.

Overview of GST:

GST, or Goods and Services Tax, represents a unified taxation system that has replaced a complex web of indirect taxes. This tax reform aims to simplify the taxation structure, promoting transparency and efficiency in the business ecosystem. With its implementation, businesses have witnessed a shift towards a more streamlined and uniform tax framework.

Importance of accurate and compliant GST invoicing:

Accurate and compliant GST invoicing stands as the cornerstone of financial integrity for businesses operating under the GST regime. Each invoice serves not merely as a billing document but as a legal record, reflecting the exchange of goods or services and facilitating the seamless flow of information between businesses and tax authorities.

In the era of digitization, terms such as e-invoice billing and invoice generator have become integral to the GST invoicing landscape. These digital solutions revolutionize the traditional invoicing process by providing electronic alternatives, enhancing efficiency, reducing errors, and aligning businesses with the contemporary demands of the digital age.

E-invoice solutions and online invoice tools.

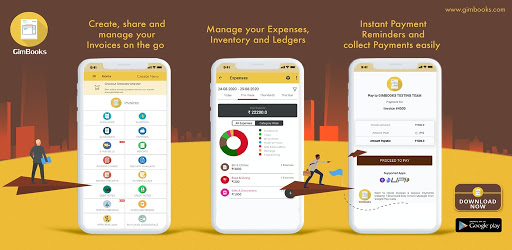

In the age of rapid technological advancements, businesses are increasingly turning to innovative tools such as e invoice generators, online invoice makers, and billing software to streamline their invoicing processes. These solutions empower businesses to create, manage, and transmit invoices with ease, fostering accuracy and compliance while saving valuable time.

Also, the introduction of e-way bill apps has added a layer of convenience to the logistics of GST-complaint transactions. You can use these apps to facilitate eway bill generate, contributing to the seamless movement of goods and ensuring compliance with GST regulations.

The advent of tools that allow businesses to make invoices online signifies a paradigm shift towards convenience and accessibility. Online invoice creator empower businesses to generate invoices from anywhere, at any time, promoting flexibility in a fast-paced digital environment.

Anticipating transactions with clarity:

Among the arsenal of invoicing tools, proforma invoices and a quotation maker stand out as invaluable instruments for businesses engaging in international trade or complex transactions. Proforma invoices provide a preview of the financial commitment, offering clarity to both parties involved before the actual goods or services are delivered.

In Closing:

As we embark on this journey into the world of GST invoicing, it becomes evident that mastering these processes involves not only adherence to regulations but also a strategic embrace of digital tools and innovative solutions. In this section, we have resolved the intricacies of e-invoicing and invoice generator, explored the functionalities of billing software, and navigated the terrain of eway bill generation, aiming to equip businesses with the knowledge needed to thrive in the era of GST.

In a simple way, billing software has simplified the process of invoice and billing, easing the burden of compliance for businesses involved in the movement of goods.