Paying utility bills online has become increasingly popular due to its convenience and speed. Many households now rely on digital platforms for electricity, water, gas, and other essential services. While the process is simple, it’s easy to make errors that can lead to financial issues, missed payments, or compromised personal information. Understanding common mistakes can help you streamline your bill payment process and ensure a safe, efficient experience.

In this article, we will discuss the mistakes to avoid when you pay utility bills online, providing actionable tips to protect your finances and make bill payment a seamless task.

Why Online Bill Payment is Convenient

Paying utility bills online offers unmatched convenience. It eliminates the need to visit payment centers, wait in long lines, or manage multiple paper bills. You can schedule payments, set reminders, and even track your spending from a single platform. Moreover, online bill payment often allows you to automate recurring bills, reducing the chance of late fees.

Despite these benefits, overlooking essential precautions can turn convenience into frustration. Understanding potential mistakes ensures you benefit fully from digital payment systems.

Common Mistakes to Avoid

1. Using Unsecured Websites

One of the most critical mistakes is using unsecured websites to pay utility bills online. Make sure the platform you choose has HTTPS encryption. Avoid entering your payment information on platforms that look suspicious or lack proper security measures. Using unsecured websites increases the risk of fraud or identity theft.

2. Ignoring Bill Details

Many users rush through the payment process without reviewing the bill carefully. Always check the due date, the amount, and any additional charges before proceeding. Paying without verification can result in overpayment, underpayment, or missed discounts. Mistakes in bill payment can also trigger late fees or service interruptions.

3. Saving Payment Information Without Security

While it’s convenient to save card or bank details for repeated bill payments, doing so without proper security can be dangerous. Ensure that the platform provides secure storage and two-factor authentication. Avoid using public or shared devices to store sensitive information.

4. Overlooking Confirmation Receipts

After completing a bill payment, always check for confirmation receipts or emails. Failing to verify a transaction can leave you uncertain about whether your payment was processed. Keeping a record of each payment helps resolve disputes and track your monthly expenses efficiently.

5. Not Scheduling Payments Properly

Many people forget to set up automated payments or reminders. Missing a payment can result in penalties and affect your credit score. If you choose manual payments, always set alerts to remind you of upcoming bills. Automating bill payments reduces the risk of human error.

6. Relying on Public Wi-Fi

Paying utility bills online using public Wi-Fi can expose your account and banking information to hackers. Always use a secure, private network when completing transactions. If you must use public Wi-Fi, consider using a reliable VPN service to encrypt your data.

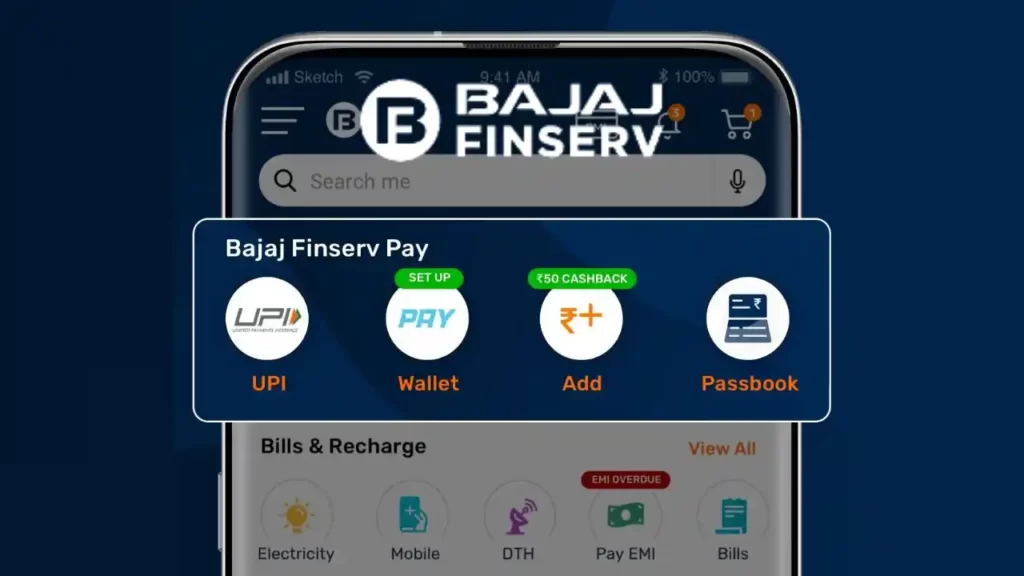

7. Ignoring Multiple Payment Options

Some platforms offer multiple payment methods like debit cards, credit cards, net banking, or UPI. Sticking to only one option without checking convenience, fees, or processing times may cause delays. Choose the method that balances speed, security, and minimal charges for an optimized experience.

8. Neglecting to Update Personal Information

If your account details or contact information change, failing to update them can create issues in bill payment. Ensure your email, phone number, and payment details are current. Updated information ensures smooth processing and timely notifications for due bills.

9. Overlooking Transaction Limits

Some banks and payment platforms set limits for online transactions. Not checking these limits can cause failed payments or partial processing. Be aware of these restrictions before initiating a bill payment to avoid last-minute stress.

10. Ignoring Budget Tracking

Paying utility bills online without tracking your expenses can lead to overspending. Use tools or apps to monitor your monthly bills, compare past payments, and budget accordingly. Smart tracking ensures that online bill payment remains convenient without affecting your financial planning.

Tips for Safe and Efficient Online Bill Payment

- Always verify the website’s security before entering payment details.

- Review each bill carefully before making a payment.

- Store payment information only on secure platforms.

- Keep transaction confirmations for future reference.

- Automate payments when possible but set reminders to monitor activity.

- Avoid public Wi-Fi and prefer private, secured networks.

- Update personal and billing information regularly.

- Choose the payment method that suits your needs and limits.

- Track monthly expenses to stay within budget.

By following these tips, you can minimize the risks associated with online bill payment and maintain a stress-free, secure process.

Conclusion

Paying utility bills online offers unmatched convenience, but it comes with responsibilities. Avoiding mistakes such as using unsecured websites, ignoring bill details, neglecting confirmations, and not tracking your budget ensures a safe and efficient experience. Always verify transactions, safeguard personal information, and update your details regularly.

When you pay utility bills online, careful attention to these practices helps prevent errors, late fees, and financial hassles. Prioritize security and accuracy in your bill payment routine, and you will enjoy a seamless, reliable way to manage your monthly expenses.

Remember, consistent and secure bill payment habits today can save you time, money, and stress tomorrow. Proper planning and attention to detail are key to making your online transactions smooth and error-free.