Starting a new business is an exciting yet challenging endeavor. Entrepreneurs often require financial support to turn their dreams into reality. In this digital age, personal loan apps have emerged as a powerful tool for empowering aspiring business owners.

A reputable instant loan app offers numerous advantages that make it easier than ever to secure the necessary funds and embark on the entrepreneurial journey.

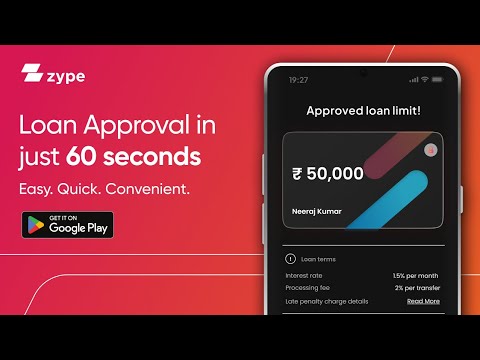

1. Speedy Approval:

Time is of the essence for entrepreneurs. Personal loan apps offer quick loan approval & instant access to funds. Unlike traditional loans that may take weeks or even months to get approved, personal loan apps often provide same-day approval, allowing business owners to take immediate action.

2. Minimal Documentation:

Personal loan apps typically require minimal documentation. Applicants need to provide basic identity and income proof and, in some cases, a credit score check. This reduces the hassle associated with gathering extensive paperwork, making the application process much more straightforward.

3. Flexibility:

Entrepreneurs often require funds for various aspects of their business, from purchasing equipment and inventory to covering operational expenses. Personal loan apps offer flexibility in terms of fund utilization. Borrowers can use the loan amount for any business-related purpose without stringent restrictions.

4. Competitive Interest Rates:

Many personal loan apps offer competitive rates with respect to traditional loans. Business owners can explore different apps to find the best interest rates and terms that suit their financial needs.

5. No Collateral Required:

Personal loans obtained through these apps are typically unsecured, meaning entrepreneurs do not need to provide collateral to secure the loan. This reduces the risk associated with a new business, as there’s no need to put personal assets on the line.

6. EMI Options:

Personal loan apps often allow borrowers to choose from various Equated Monthly Installment (EMI) options. This flexibility in pay later facilities helps entrepreneurs manage their cash flow effectively by selecting a repayment schedule that aligns with their business revenue projections.

7. Simplified Repayment:

Repayment of personal loans through apps is straightforward. Most apps offer automatic debits from the borrower’s linked bank account, ensuring that monthly payments are made on time. This simplicity minimizes the risk of missing payments and incurring penalties.

8. Building Credit History:

Timely repayment of a personal loan taken through an app can help entrepreneurs build a positive credit history. A strong credit profile can be valuable in the future when seeking additional financing for business expansion.

9. Privacy and Security:

Personal loan app India prioritizes the privacy and security of user information. They use advanced security protocols to protect sensitive data, making the borrowing process safe and secure.

10. Transparency:

These apps often provide clear terms and conditions, ensuring that borrowers fully understand the loan agreement. There are no hidden charges or surprises, promoting transparency in the borrowing process.

11. 24/7 Availability:

Business opportunities may arise at any time. Personal loan apps are available 24/7, allowing entrepreneurs to seize opportunities promptly. Whether it’s securing inventory at a discounted rate or taking advantage of a time-sensitive business deal, these apps provide the flexibility to act when the moment is right.

In conclusion, a reputable quick loan app can become an indispensable tool for entrepreneurs looking to start new businesses. They offer accessibility, speed, flexibility, and convenience in securing funds. As technology continues to advance, personal loan apps play an even more significant role in empowering individuals to pursue their entrepreneurial dreams.