In a time when smartphones have grown to be extensions of ourselves, handling money has changed drastically. With banking apps leading the front stage in this transition, the advent of digital technology has brought in a new era of financial management. These strong instruments, which provide unheard-of convenience and control in our hands, are changing our interaction with our money. This article explores the main advantages and features of modern banking software, therefore improving your financial management experience.

The Power of Mobile Banking:

Mobile banking apps have transformed our interaction with funds. These strong instruments provide a variety of solutions that simplify and ease money management more than ever before. Some of the key benefits are:

- 24/7 account access

- Real-time transaction tracking

- Bill payment and fund transfers

- Budgeting tools and spending insights

One of the most essential tools offered by many banking apps is the ability to run a credit score check. This feature makes regular monitoring of creditworthiness possible, helping consumers make wise financial decisions and aim to raise their credit scores.

Empowering Financial Decision-Making:

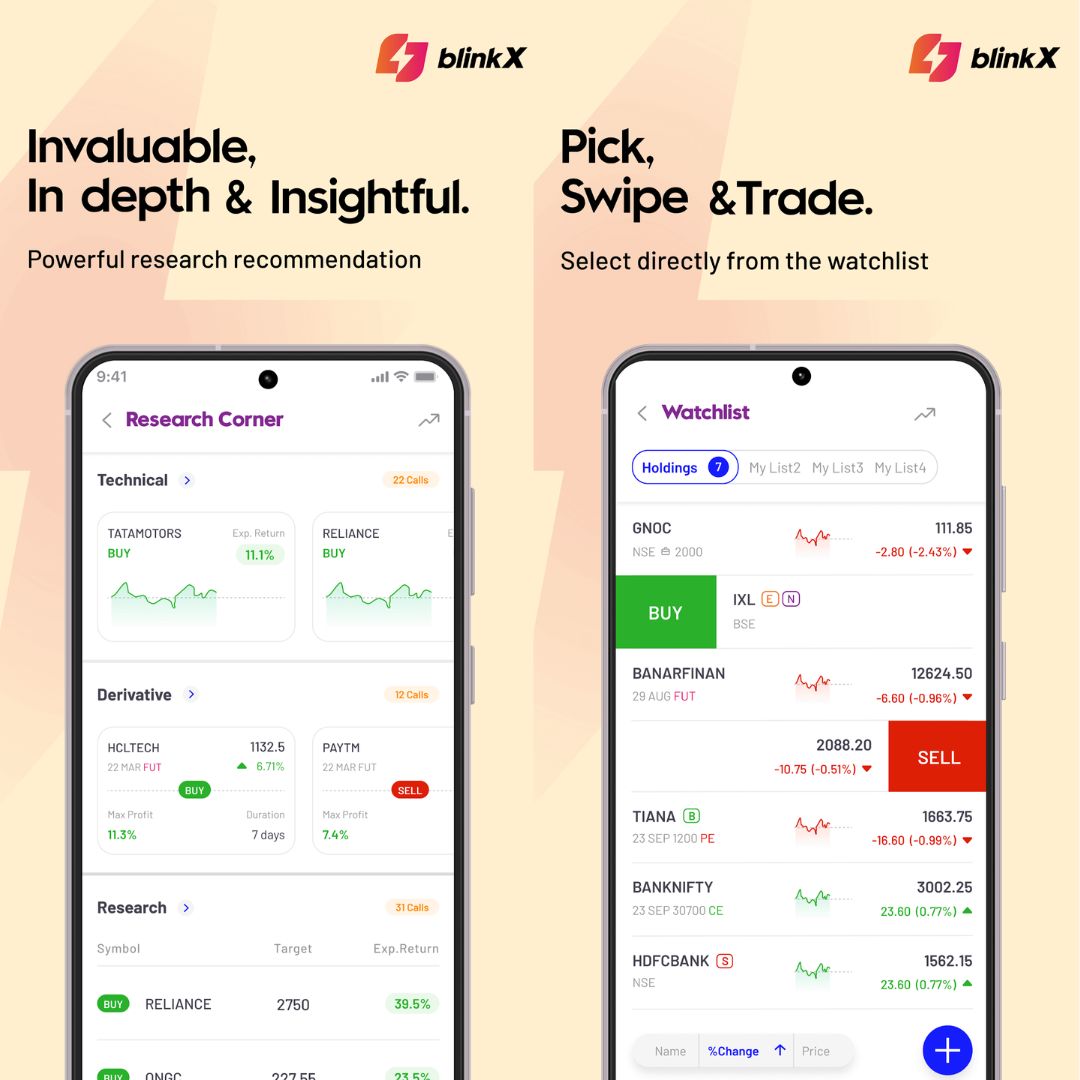

Modern banking apps go beyond basic account management. They generally contain complex calculators and planning tools to assist customers in making informed financial decisions. For example, a fixed deposit calculator can help you evaluate the possible returns on your investments, helping you prepare for future goals more effectively.

Similarly, an investment calculator may be an important resource for anyone trying to expand their wealth. These apps typically allow users to:

- Project potential returns on various investment options

- Compare different investment scenarios

- Adjust variables such as investment amount, duration, and expected rate of return

By delivering these calculators within the app, banks empower their consumers to make more informed decisions regarding their financial future.

Comprehensive Financial Management:

Many banking apps are upgrading to provide all-inclusive financial management solutions as they continue to develop. Asset management is one field in which this is particularly evident. Modern banking apps often provide features that allow users to:

- Track multiple accounts and assets in one place

- Monitor investment performance

- Set financial goals and track progress

- Receive customized investment advice and suggestions

This comprehensive approach to financial management enables consumers to have a clearer picture of their overall financial health and make more sensible decisions regarding their money.

Security and Privacy:

While the convenience of banking apps is undeniable, security remains a top priority. Modern banking applications employ state-of-the-art security measures to protect users’ sensitive information:

- Multi-factor authentication

- Biometric login options (fingerprint or facial recognition)

- End-to-end encryption for data transmission

- Alerts and fraud detection in real-time

While taking advantage of digital banking’s advantages, users stay calm knowing that their financial information is secure.

Conclusion:

The emergence of banking apps has altered the way we manage our accounts, delivering unprecedented ease, insight, and control. From completing a fast credit score check to using complicated investment calculators, these tools empower users to take command of their financial future. As technology continues to upgrade, we can expect banking apps to become even more vital to our financial lives, giving increasingly personalized and comprehensive solutions for managing our money in the digital era.