If you need immediate access to cash, an instant cash loan could be the solution. Bills and transactions that require immediate attention should not be delayed. In this blog, we’ll go over how cash loans operate and how to apply for them. You can get cash loans online from a variety of providers, including peer-to-peer lending platforms, NBFCs, and banks.

As its name suggests, a cash loan is a form of borrowing in which money is often provided in real cash. It’s a conventional approach to borrowing but not necessarily the most convenient in today’s digital world.

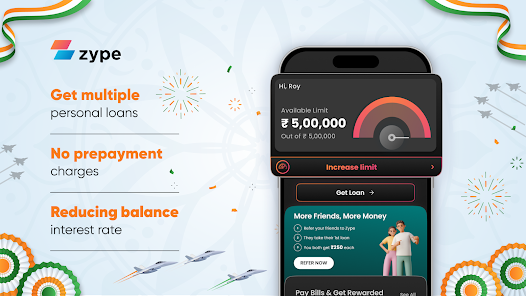

However, the word “cash loan” has changed over time. In modern finance, individual loans are often known as cash loans. Despite their similarity, individual debts have many benefits and characteristics that make them more attractive options for borrowers. They are also more convenient and efficient, which makes them a popular choice for many people in search of a same-day cash loan. Here are some benefits of cash loans mentioned in the article.

When it comes to cash loans, there are several features and benefits to consider, making them an easy and appealing financial option. Here, we look at the advantages of these loans:

Instant Disbursement:

Getting an instant cash loan in 5 minutes is simple and convenient. Download one of the loan apps to start the loan application procedure. Click on ‘Cash Loan,’ and you’ll be directed through the procedures of entering your personal information, completing your KYC (Know Your Customer), and selecting your preferred loan amount and tenure.

Minimal documentation:

The days of heavy documentation are over. The documentation requirements for quick cash loans are short and straightforward. A few vital facts, like your name, address, and PAN or Aadhaar number. You can update all of this using a cash loan app.

Flexible EMI Options:

Repayment should not cause stress. Cash loans offer flexible EMI alternatives. You can repay the loan when it is convenient for you, and the loan term can be extended up to 72 months or six years, providing a flexible repayment schedule.

Paperless process:

Instant cash loans require no human intervention and no paperwork. From the first application to the loan disbursement, the entire procedure is paperless, making it easier for borrowers.

Attractive interest rates:

One of the most appealing aspects of cash loans is their low interest rates. Various platforms provide cash loans with competitive interest rates starting at about 2-9% per year, making them a cost-effective pay later borrowing solution.

No collateral is required:

Simple cash loans allow you to borrow up to 20 lakhs without pledging without any protection. This flexibility enables you to use money for a wide variety of financial requirements, all without endangering your property.

These benefits make cash loans a practical and efficient financial solution, allowing less effort and maximum ease of money. While cash loans are a wonderful choice for meeting immediate financial demands, you may be interested in researching options for more specific costs.