In our fast-paced lives, managing money effectively is more crucial than ever. Thankfully, the landscape of quick funds and financial solutions has evolved, making things more accessible. Let’s simplify these ideas to better understand how they serve as valuable tools for managing your finances.

1. Instant credit lines – swift access to funds

Instant credit line operates like a reliable friend who lends you money whenever you need it urgently. This financial tool provides quick access to funds, acting as a safety net during tight financial situations.

Unlike traditional loans with lengthy approval processes, instant credit provides a quick and straightforward solution. To activate this feature, you generally need to demonstrate a stable income source. Once activated, you can tap into this resource whenever you require extra funds promptly.

The best part is that your credit does not replenish with revolving lines of credit. As soon as you make the repayment, the total credit pool is again available to you for making various expenses. In other words, you wouldn’t have to repeatedly apply for a credit line.

2. Instant loan apps – your convenient financial allies

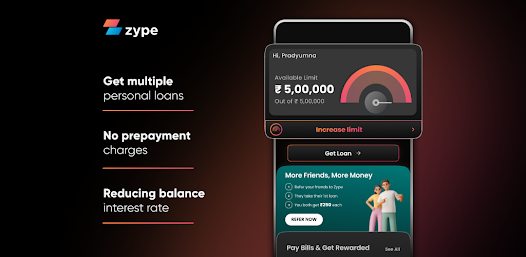

Think of an instant loan app as your personal financial hub, conveniently located on your phone. By providing the necessary details, you can apply for a loan seamlessly, receive swift approval, and have the funds directly transferred to your account.

These apps simplify the borrowing process, offering a convenient and quick way to secure funds. Whether for emergencies or planned expenses, loan apps provide a hassle-free avenue, making financial assistance as easy as navigating any other application on your phone.

An easy EMI loan breaks down substantial bills into manageable, fixed monthly installments. Rather than facing a hefty one-time payment, you can spread the cost over several months.

Understanding Equated Monthly Installments (EMI) is akin to breaking down significant expenses into manageable, bite-sized portions. Easy EMI loans allow you to repay in installments, making it easier to afford items like gadgets, appliances, or even medical bills.

This approach, similar to paying for a pizza through incremental slices, ensures that you can handle your financial commitments without straining your budget.

Credit solutions, encompassing instant credit, credit loan, and easy EMI loans, offer versatility to meet diverse financial needs. These tools act as all-in-one solutions, providing access to immediate funds, ongoing credit, and structured repayment plans. Consider them as adaptable financial instruments designed to cater to your specific requirements, ensuring financial security and peace of mind.

Before proceeding with any form of credit, it’s always a good practice to read the terms to avoid financial surprises. Furthermore, it’s important to ensure that you’re borrowing responsibly.

In a nutshell,

All in all, having a clear understanding of instant credit, loan apps, easy EMI, and credit solutions need not be daunting. These financial tools are designed to simplify your financial journey, offering swift access to funds, convenient borrowing options, and adaptable solutions for various financial scenarios. By understanding and utilizing these tools wisely, you can enhance your financial well-being and confidently navigate the complexities of modern finance.