In our current, swift-moving era dominated by tech advancements, the process of obtaining personal loans has experienced a considerable shift. Long gone are moments when we went to physical bank establishments while handling heaps of paperwork. We’re now living in an online lending epoch where instantaneous virtual loans have gained prominence as economic instruments.

This piece investigates contemporary movements within instant web-based loans and their influence on redefining financial borrowing.

1. The Rise of Digital Lenders

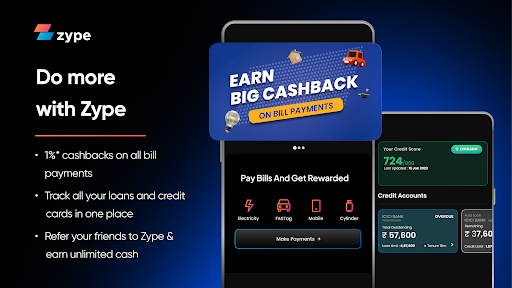

A significant shift in the instant personal loan app space is the new surge of digital lenders. Classical banks and credit unions aren’t any more exclusive lending choices for borrowers. Virtual advancing portals, along with fintech firms, have taken a strong stand as rivals, furnishing customers with an easy and effective method to gain capital.

Digital credit line utilize technological advances to cut down application and consent procedures timeframes, enabling applicants to wrap up their requests within minutes before getting funds transferred into accounts almost immediately after approval.

This evolving framework has made borrowing more impartial by making financial facilities reachable to broader audiences, including those having short or inadequate credit records.

2. Personalized Loan Products

In the digital era, lending with an online loan app is experiencing a shift towards custom-made loan services. Traditional loans often come with stringent frameworks and approval requirements, which can pose difficulties for borrowers with unique financial conditions to obtain funds. However, online moneylenders have warmly welcomed AI-driven formulas coupled with data-backed algorithms in order to fine-tune their loan offerings to suit individual needs.

These kinds of lenders employ multiple information pointers such as credit ratings, earnings records, and job timelines aside from even social media activities while evaluating an applicant’s trustworthiness concerning credits. This permits them to present borrowings aligning precisely with terms and interest rates that match keenly into the borrower’s economic backdrop, creating an all-inclusive finance borrowing experience much more personalized.

3. Quick and Convenient Application Processes

Instant online loans like home loan, easy EMI loan, etc., mainly have the benefit of a swift and accessible application process. Loan borrowers can utilize this facility from their comfort zone or while traveling with devices such as smartphones, tablets, or computers at hand. The documentation requirements for these digital applications are minimalistic compared to traditional loan procedures, providing less hassle. Furthermore, many virtual lending institutions provide on-the-spot decision-making functionality.

This allows applicants to know about their loan approval status in just minutes, which cuts down long waiting periods often experienced otherwise. This quick processing time proves highly beneficial during urgent situations where people require prompt financial assistance.

4. Alternative Credit Scoring Models

Traditional credit scoring models heavily rely on credit history, which can disadvantage individuals with limited or no credit history. To address this issue, many online lenders are embracing alternative credit scoring models. These models consider a broader range of factors beyond traditional credit reports.

5. Increased Regulatory Scrutiny

The booming popularity of immediate online lending has captured the attention of regulatory bodies with strong concerns about customer safety and equitable loaning practices. To manage this digital industry, different jurisdictions have either introduced or revised their rules. These regulations address crucial areas such as cap limits on interest rates, clear transparency in lending terms, plus safeguarding data privacy.

Despite these new guidelines designed to protect borrowers presenting significant compliance hurdles for electronic lenders, they are committed to achieving a balance between innovative offerings and adherence to laws by ensuring the fulfillment of official requisites without compromising on the provision of convenient loans.

Conclusion:

Digital lending offers convenient and accessible loan options. Fintech innovations enable quick and easy application processes with alternative credit scoring models for wider access. However, increased regulatory scrutiny and security measures are crucial for informed financial decisions as the industry evolves.