Getting all your finances well in order can be a difficult task and needs an ample amount of effort, dedication and time. For buying a new home, organizing a marriage function, going abroad for further studies, or commencing a new business, all of it needs huge capital. Though all of these come under the category of planned expenses, several times, people are needed to handle unforeseen expenses, such as paying for a hospital bill.

As few people manage to take care of monetary emergencies with their savings, others may think of taking out an instant personal loan or borrowing funds. However, the question here is, how to determine the correct course of action?

To assist you with making the most appropriate decision, stated below are some of the pros of taking an instant personal loan online and how it works during times of adversity.

- Less expensive in the long term:

Instant credit can be more expensive than using your savings presently; however, in the long run, your investments may fetch you better returns when compared to the amount you pay in the form of interest on the loan.

- Let you decrease the tax burden:

This is another hidden advantage of taking an instant loan India that enables you to alleviate your tax burden. This is so because in our country, the interest cost from acquiring a loan decreases the taxable amount and curbs the tax amount. An individual can save a decent amount on tax when opting for a loan, and the interest can be offset by utilizing several deductions available as per the Income Tax Act of India regarding loans.

- Inculcates financial discipline:

Getting a loan needs discipline regarding effectively handling the monetary expenses, particularly about investment and spending habits in the starting days till a person has sufficient amount to redeem it. Hence, a favorable part of getting a loan is that it helps you make the best use of every single penny and lets the borrower have a financially systematic life.

- It can be used for multiple purposes:

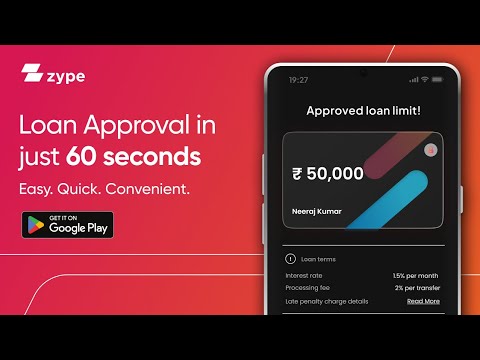

An instant personal loan app can help you with several uses. Generally, there are no constraints as to how borrowers can select to spend their amount, which implies greater flexibility when it comes to spending.

If you wish to stay financially sound in the long term, try to make use of your savings for consumption reasons and debt for investment purposes. For instance, a debt like an educational loan or home loan can be repaid in the future and will add value to your credit score.

The best part about getting a loan is you can select your own EMI repayment option scheme and handle your funds according to your needs. To know the amount of loan that you can get, install an instant loan app and make your profile on the same.

Conclusion:

Irrespective of whether an individual is better off by getting a loan or by using savings, it depends on their financial situation. Various other aspects consist of a person’s capacity to save and their strategies for repayment.

There are various ways to get an instant personal loan online without the need for collateral and high credit scores. Many instant loan apps provide loans for lakhs of rupees for business, travel, home repair or even for getting stuff such as cars, bikes, refrigerators, etc., without requiring any collateral. Such instant loans can be availed with single-day approvals and prompt disbursals.